For years, the startup promise was simple:

Join early. Take less salary. Own a piece of the upside.

That was the gospel of Silicon Valley — the tradeoff that made builders out of dreamers and believers out of employees.

But as Andrew Endicott of Gilgamesh Ventures puts it, that promise has cracks running through its foundation.

Because in most startups, you don’t own equity.

You own the option to buy it.

And that difference — between the story you’re sold and the structure you’re given — changes everything.

🎧 Listen to this podcast episode on YouTube or Spotify

The Illusion of Ownership

Founders love to tell new hires, “You’ll own part of the company.”

It sounds fair. It feels inspiring.

But behind that promise sits a complex tangle of tax codes, legal clauses, and invisible time bombs.

When an employee joins a startup, they’re often granted stock options, not stock itself.

Those options come with a “strike price” — the fair market value of the shares at the time of the grant.

Sounds harmless, until you realize that to actually own those shares, you must buy them — often after you’ve already left the company, in a narrow 90-day window, and without access to full financial information.

So when that moment arrives, you’re forced into an impossible choice:

Come up with a high-figure sum to exercise your options, or walk away from what you helped build.

For many, the dream of ownership ends right there.

Optimism as a System

Andrew calls it a system built on optimism — and maybe that’s the problem.

Founders, driven by belief and momentum, rarely understand the intricate mechanics of capitalization or preferred share waterfalls.

Employees, caught up in the same dream, often don’t know what questions to ask.

And so, the same optimism that fuels startup culture also blinds it.

The investor understands the structure.

The founder half-understands it.

The employee barely sees it at all.

And between those three, entire fortunes quietly disappear — not because of bad luck or bad intent, but because of bad design.

When Equity Isn’t Equal

In the U.S., a regulation called 409A shapes how startups value and issue options.

It’s meant to prevent abuse, but in practice, it locks employees into a framework where “ownership” is deferred, taxed, and often unattainable.

Meanwhile, the preferred stock held by investors — the kind that gets paid first — sits quietly above everything.

When a company exits for less than its total investment, employees often walk away with nothing, even after years of contribution.

It’s not a scandal.

It’s standard practice.

Liquidity as a Luxury

Here’s another flaw: liquidity.

In theory, startup equity is wealth.

In practice, it’s a waiting game.

Until an IPO or acquisition, there’s often no way for employees to sell or even value their shares.

And when they leave the company, that wealth turns into a bill.

“Pay now, maybe profit later.”

Some platforms now offer financing for exercising options, but they come with costs and restrictions.

They help, but they don’t fix the fundamental problem — that ownership, in this system, is something employees have to buy back from their own employer.

The Case for Redesign

Andrew’s solution is both practical and radical:

Stop calling options “equity.”

Start giving employees actual stock.

He argues that startups could grant common shares outright and cover the tax implications through a “gross-up” — effectively paying the taxes on behalf of the employee.

Yes, it’s more expensive for the company.

But it’s fairer, simpler, and truer to the spirit of shared ownership.

He also believes companies should extend exercise periods — from 90 days to several years — giving employees time, flexibility, and dignity in how they handle their stake.

Ownership should feel like a reward, not a ransom.

Lessons from Stripe and Windsurf

Andrew points to two real-world examples: Stripe and Windsurf.

Stripe, faced with expiring options after a decade in operation, raised liquidity so employees wouldn’t lose what they’d earned. They didn’t have to — but they did. A rare case of a company honoring both its word and its workforce.

Windsurf, on the other hand, became a cautionary tale.

Its acquisition left employees with far less than expected, while the founder reportedly benefitted disproportionately.

Different outcomes. Same system.

And that’s the lesson:

Even when founders and investors act with good intentions, the rules of the game can still fail the people who helped build the product.

Rethinking the Promise

Startups pride themselves on disrupting old systems — banking, healthcare, transportation, education.

But maybe it’s time they disrupt one closer to home:

how they share value with the people who make their vision real.

Because equity shouldn’t just be a line in an offer letter.

It should be ownership in the truest sense — participation, not speculation.

The next generation of founders won’t just build new markets.

They’ll build new models of fairness.

And that shift — from options to ownership — might be the most meaningful innovation of all.

Additional Nuggets

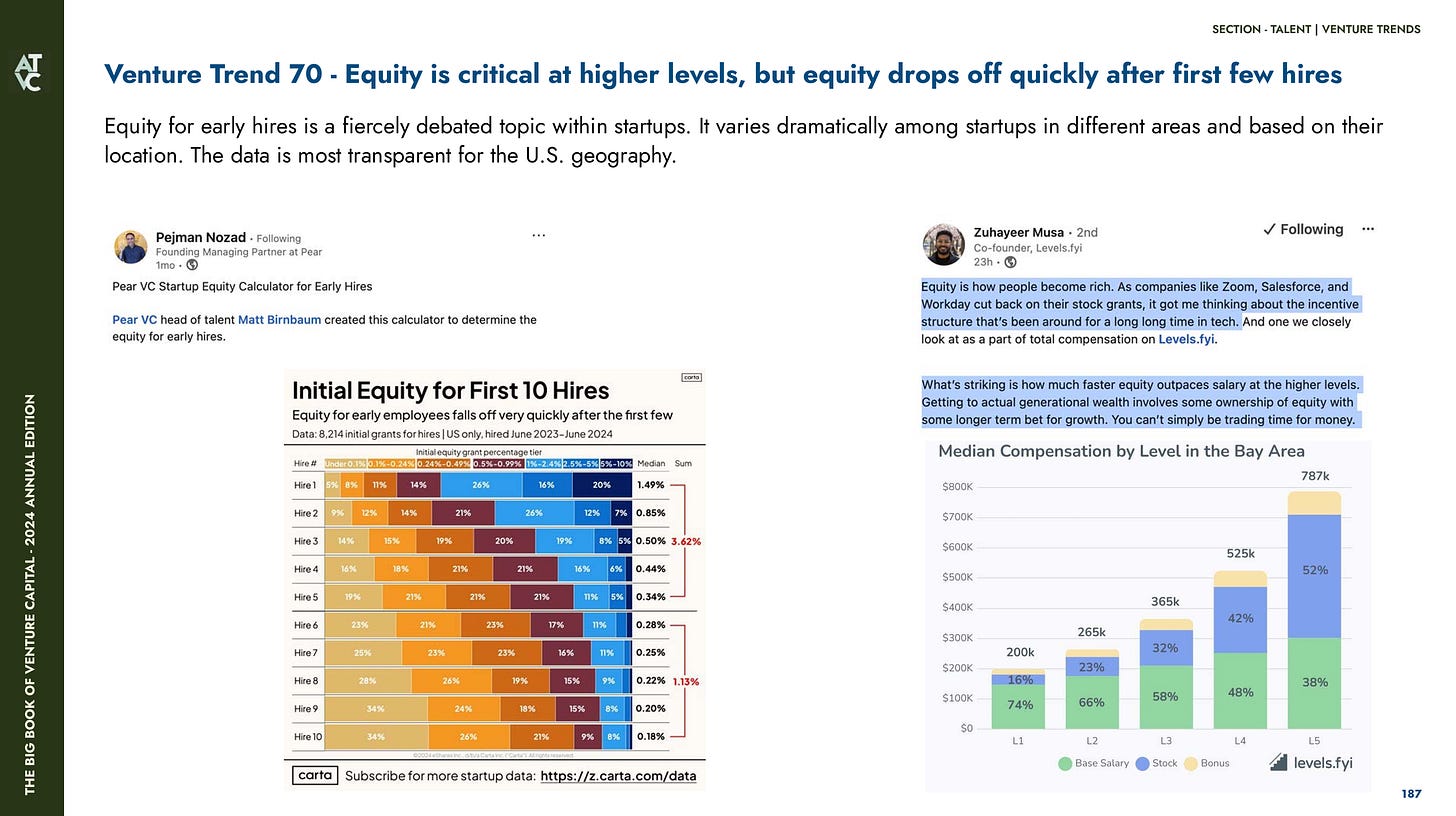

Venture Trend 70 – from The Big Book of VC 2024 Annual version

Equity is critical at higher levels, but equity drops off quickly after first few hires

Equity for early hires is a fiercely debated topic within startups. It varies dramatically among startups in different areas and based on their location. The data is most transparent for the U.S. geography.

Topics covered in the podcast

(00:00) Episode intro – Rohit introduces TheOnePoint Podcast and guest Andrew Endicott

(01:01) Inside Gilgamesh Ventures – investing in the future of global fintech

(02:48) U.S. and international portfolio – why Latin America is a growth hub

(04:16) Fintech’s comeback and today’s topic: the evolution of employee ownership

(05:02) Understanding startup equity – how tax rules shape employee stock options

(08:23) Why employee stock options don’t always deliver expected value

(11:34) The communication gap – why equity education matters for teams

(16:10) How founders can create clarity and transparency in equity discussions

(18:54) Exercising stock options – timing, financing, and employee planning

(23:05) Rethinking company policy – extending exercise periods and real ownership

(24:51) Exploring common stock models and how tax support can help employees

(31:21) Lessons from leading companies – approaches to long-term employee rewards

(36:39) Key takeaways – building fair and transparent equity structures