Who doesn’t love a great American hustle story, and that too in venture capital!

That’s exactly what Jared Carmel has built with Manhattan Venture Partners. From helping a Facebook employee in 2009 find liquidity for their shares, to pioneering the institutionalization of venture secondaries with over $1.5B in AuM, Jared has turned a scrappy idea into a top-ranked firm.

Along the way, MVP’s All-Star Fund has landed Bloomberg’s #2 and #3 spots in best-performing VC funds under $500M, and PitchBook has named them a top five U.S. secondary investor.

And his story has a very present footing.

🎧 Listen to this podcast episode on YouTube or Spotify

For years, venture capital had one playbook: fund startups early, ride them to IPO, and call that liquidity. Turns out, that was just the warm-up.

The real shift? Secondaries.

What Jared calls “tomorrow’s IPOs today” is no longer niche—it’s the structural rewiring of venture.

▪️ The Timeline is Broken. In 2000, startups went public at 3 years old. By 2021, it was 13. Klarna just went out at 17. Jared’s prediction: the best companies will stay private for 20 years. IPOs can’t clear the backlog—secondaries must.

▪️ Institutionalization is Here. Discounts have collapsed from 55% to 13%. Every major Wall Street bank has a desk. What was the wild west is now the trading floor.

▪️ Liquidity is Survival. Employees can’t wait 15 years for a payday. RSUs expire, mortgages don’t. Tender offers, structured programs, continuation funds—they’re not perks anymore, they’re mission-critical infrastructure.

▪️ The Overlooked Edge. Everyone chases OpenAI and SpaceX. MVP thrives on the “everything else”—the Hawkeye 360s, Rapid SOS, Agility Robotics. Founders need pressure valves. Investors need overlooked gems.

▪️ The Big Picture. IPOs aren’t dying—they’re mutating. From capital raises to liquidity clearings. That only strengthens secondaries’ role.

This isn’t a hype cycle. It’s the biggest structural shift in venture capital history. If innovation is going to thrive, liquidity can’t be an afterthought.

And as Jared put it: “You can’t have innovation without rewarding the people building it. If public markets won’t do that job anymore—secondaries will.”

It’s a very punchy episode with thoughts that would either make you think or make you choose sides.

More Secondaries Nuggets

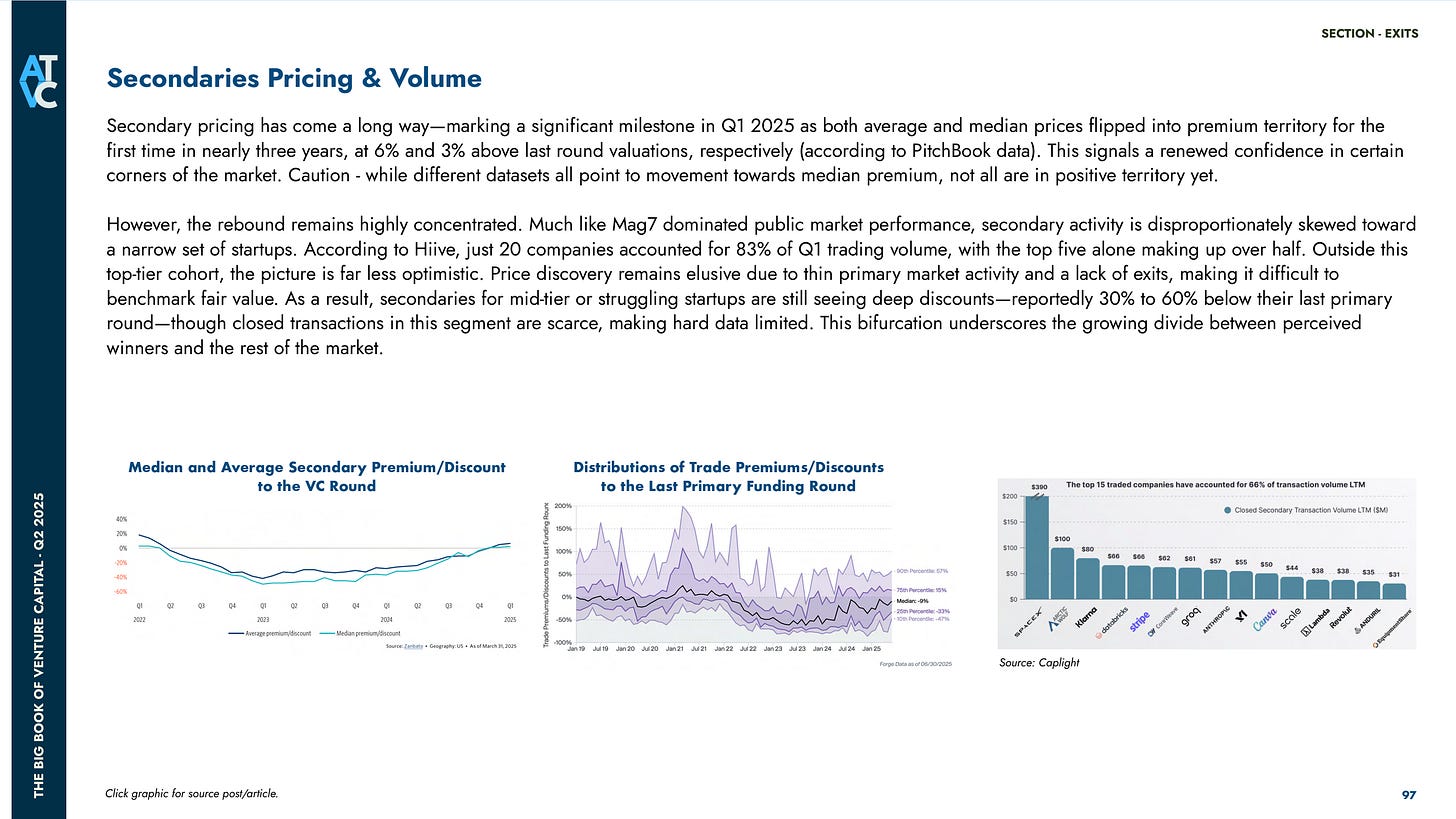

Secondaries Pricing and Volume – from The Big Book of VC, Q2 2025

Secondary pricing has come a long way—marking a significant milestone in Q1 2025 as both average and median prices flipped into premium territory for the first time in nearly three years, at 6% and 3% above last round valuations, respectively (according to PitchBook data). This signals a renewed confidence in certain corners of the market.

Caution - while different datasets all point to movement towards median premium, not all are in positive territory yet. However, the rebound remains highly concentrated. Much like Mag7 dominated public market performance, secondary activity is disproportionately skewed toward a narrow set of startups. According to Hiive, just 20 companies accounted for 83% of Q1 trading volume, with the top five alone making up over half. Outside this top-tier cohort, the picture is far less optimistic. Price discovery remains elusive due to thin primary market activity and a lack of exits, making it difficult to benchmark fair value. As a result, secondaries for mid-tier or struggling startups are still seeing deep discounts—reportedly 30% to 60% below their last primary round—though closed transactions in this segment are scarce, making hard data limited. This bifurcation underscores the growing divide between perceived winners and the rest of the market.

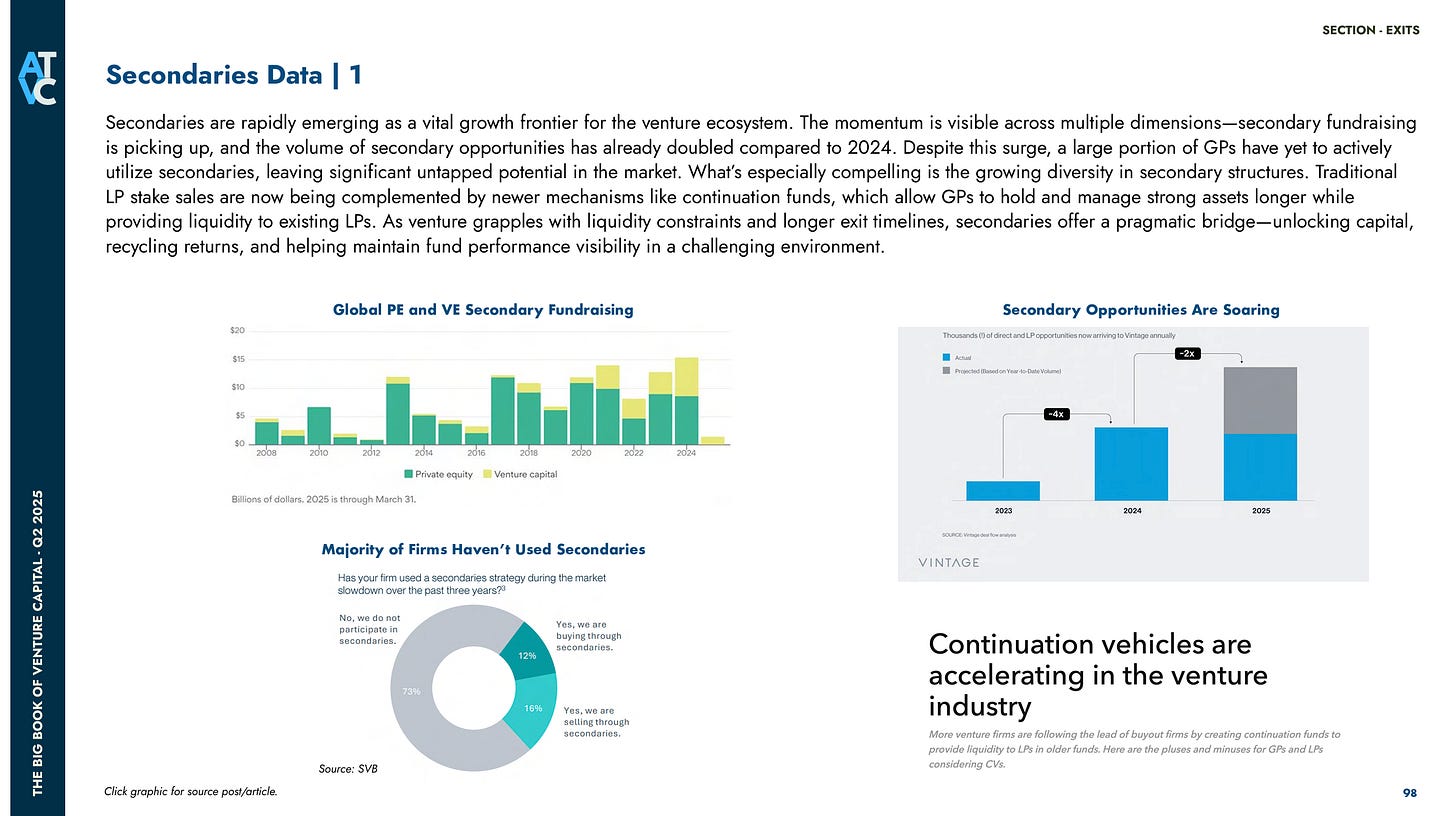

Secondaries Data - from The Big Book of VC, Q2 2025

Secondaries are rapidly emerging as a vital growth frontier for the venture ecosystem. The momentum is visible across multiple dimensions—secondary fundraising is picking up, and the volume of secondary opportunities has already doubled compared to 2024. Despite this surge, a large portion of GPs have yet to actively utilize secondaries, leaving significant untapped potential in the market. What’s especially compelling is the growing diversity in secondary structures. Traditional LP stake sales are now being complemented by newer mechanisms like continuation funds, which allow GPs to hold and manage strong assets longer while providing liquidity to existing LPs. As venture grapples with liquidity constraints and longer exit timelines, secondaries offer a pragmatic bridge—unlocking capital, recycling returns, and helping maintain fund performance visibility in a challenging environment.

What all we discussed:

(01:17) Introduction to the episode and the Rethinking Venture Capital report

(02:30) Meet Jared Carmel and the story behind Manhattan Venture Partners

(04:25) How MVP approaches secondaries: “tomorrow’s IPOs today”

(07:35) Jared’s early journey: Facebook, Citizen VC, and lessons learned

(10:15) Why secondaries matter as companies stay private longer

(14:25) Market dynamics: AI headlines vs. overlooked opportunities

(17:45) Growing investor interest and the role of family offices

(20:45) How MVP evaluates discounts, premiums, and opportunities

(22:05) The employee equity challenge: stock options, RSUs, and liquidity

(26:30) Inside the All-Star Fund: strategy and building long-term networks

(28:45) Distressed sellers, disruptive companies, and market discipline

(35:00) The evolving role of IPOs and how secondaries fit in

(37:45) Emerging opportunities in infrastructure beyond AI

(41:45) Transparency, information flow, and market maturity

(43:00) Closing reflections on the future of secondaries in venture capital