Series A used to be the “first real round.” Today, it looks more like the old Series B.

The shift is measurable. Median Series A round size in the U.S. has climbed into the $15–20M range — nearly double a decade ago. Meanwhile, the so-called jumbo Seeds ($5–9M) have taken over the slot Series A once occupied. Labels changed, expectations escalated.

🎧 Listen to this podcast episode on YouTube or Spotify

Samit’s Founder’s Handbook is also a treasure.

Especially the chapter on – How to Nail Your Series A Deck

What does that mean in practice?

1. ARR thresholds are blurry

The old heuristic — $1M ARR → ready for A — is now dangerous. In crowded spaces, 8–10 companies can all show similar traction. Investors hesitate to pick and instead wait for clearer breakout signals.

2. Decks as filters

Funds see hundreds of decks each month. Overloaded “consulting decks” kill momentum. One idea per slide, ≤15 slides, and a single killer proof point up front (graph, team, or contrarian market insight). The goal isn’t to inform — it’s to qualify.

3. Execution velocity

Follow-on times have compressed. A compelling wedge gets copied in weeks, not years. Founders that raise A’s today typically show:

Rapid multi-product expansion (not just a single line of business)

Fast team scaling (5–6 strong hires in year one vs. none)

Enterprise adoption signals (household logos early)

4. Narrative as segmentation

Investors don’t just need to believe in you — they need a reason you’re different from the other nine credible players. Market segmentation (e.g., auto shops vs. data labelers in AI hiring) turns noise into thesis. Without it, your story blends in.

5. Process math

Expect ~40 investor meetings to close a Series A. Preparation runs ~1 month (story, deck, data room) followed by ~1–2 months of meetings. Underprepared founders rarely get a second chance.

The pattern is clear:

Round labels shifted up one notch.

Growth rates inflated by outlier AI cases distort benchmarks.

Execution signals now matter more than raw ARR.

Series A hasn’t vanished — it’s just priced, sized, and judged like yesterday’s Series B.

Glad that Samit Kalra (from 1984 Ventures) joined and shared all these insights.

As he aptly said, “Execution beats theoretical moats,” and “It’s just so hard to raise right now that you might as well give it your best shot.”

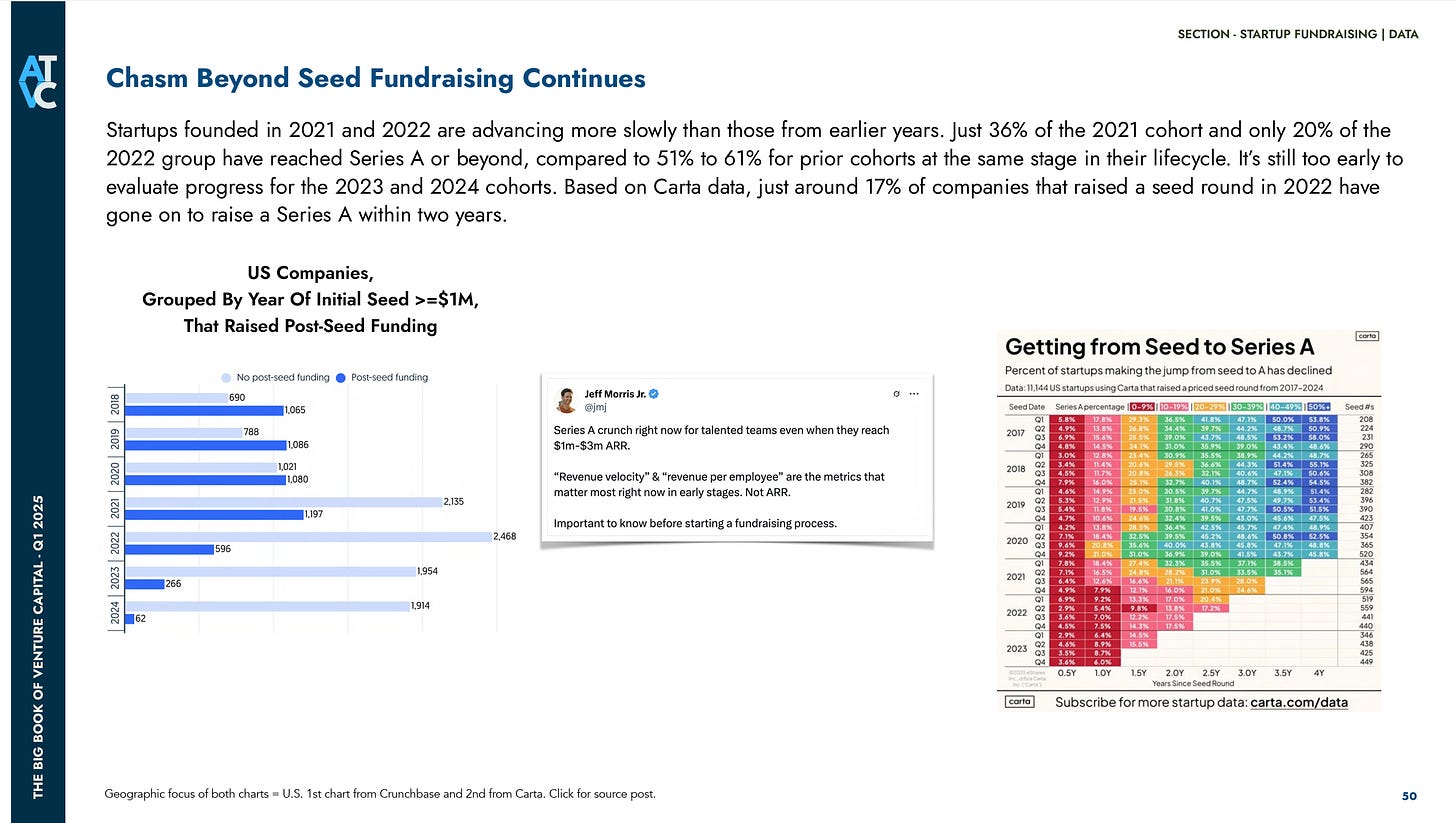

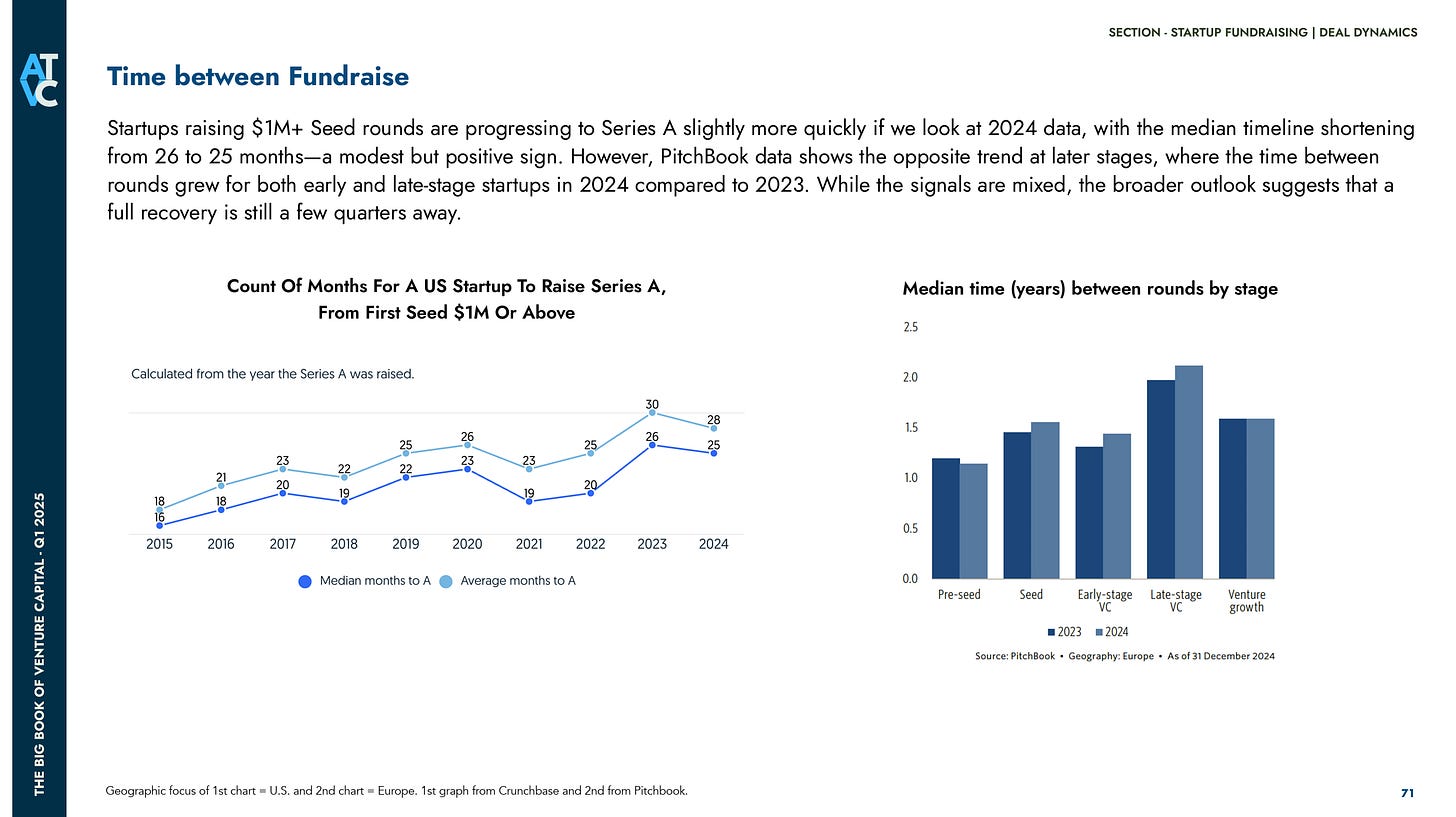

Snapshots from the Big Book of VC Q1 - 2025

Chasm Beyond Seed Fundraising Continues – “Startups founded in 2021 and 2022 are advancing more slowly than those from earlier years. Just 36% of the 2021 cohort and only 20% of the 2022 group have reached Series A or beyond, compared to 51% to 61% for prior cohorts at the same stage in their lifecycle. It’s still too early to evaluate progress for the 2023 and 2024 cohorts. Based on Carta data, just around 17% of companies that raised a seed round in 2022 have gone on to raise a Series A within two years.”

Time between Fundraise: “Startups raising $1M+ Seed rounds are progressing to Series A slightly more quickly if we look at 2024 data, with the median timeline shortening from 26 to 25 months—a modest but positive sign. However, PitchBook data shows the opposite trend at later stages, where the time between rounds grew for both early and late-stage startups in 2024 compared to 2023. While the signals are mixed, the broader outlook suggests that a full recovery is still a few quarters away."

Key chapters in the podcast discussion

(00:00) Episode intro and context on the new fundraising environment

(02:10) Samit introduces 1984 Ventures and focus areas: AI, digital health, open source

(02:53) What differentiates 1984 Ventures from other VC funds

(04:41) Investment framework: why execution beats theoretical moats

(07:22) Case study: Alex.com and execution signals that matter

(10:04) The Series A pitch deck strategy and top three must-haves

(13:49) Key differences between a Seed deck and a Series A deck

(17:22) Why Series A has become the new Series B

(20:31) Defining the “Jumbo Seed” and how founders should position rounds

(21:49) On AI hypergrowth benchmarks and why most founders should ignore them

(24:17) Standing out in crowded markets through thoughtful segmentation

(27:00) Why most founders are unprepared for fundraising and how to prepare